AFTER AN ACCIDENT MOST PEOPLE IN MICHIGAN DO NOT KNOW WHAT BENEFITS THEY ARE ENTITLED TO FROM THE INSURANCE THEY PAY FOR OR THE OTHER OPTIONS FOR BENEFITS

*This outline is for informational purposes only. The outline addresses the most common situations; there are several other factors that go into analyzing a case and many complexities to the law. Please contact us to discuss the specifics of your case

Benefits for injured persons in auto accidents (First Party Claims):

Medical Expenses

Survivor’s loss

Funeral Expenses

Work Loss Reimbursement

Replacement Services (Chores)

Attendant Care (Nursing type assistance)

Who is disqualified from coverage?

A person who unlawfully uses a motor vehicle

An owner of an uninsured vehicle

A non-resident of Michigan, unless they are occupying a vehicle that has Michigan No-Fault Coverage

A named excluded operator on the insurance policy

*Not an exhaustive list

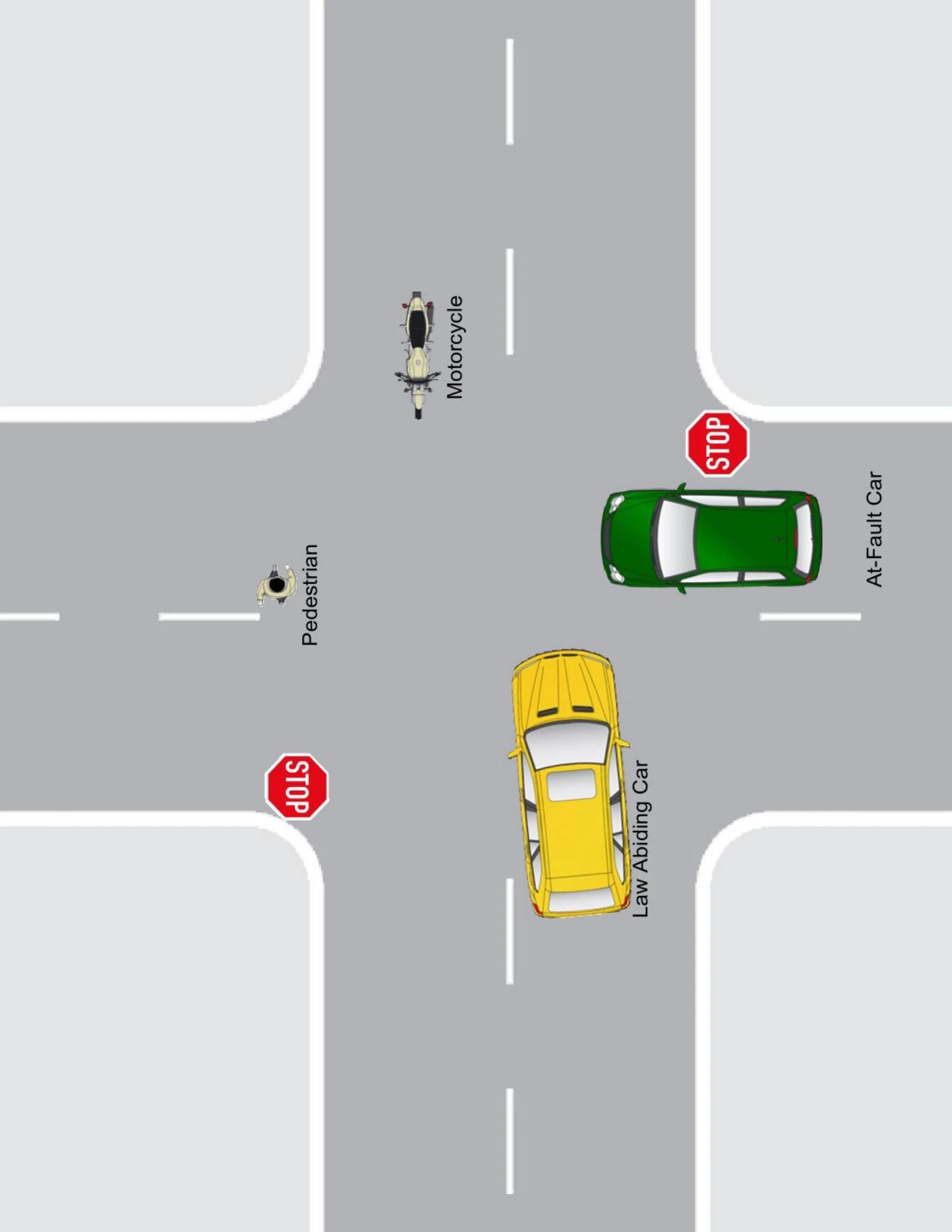

Let’s use this diagram of an impending accident to help explain. After the accident, EVERYONE IS ENTITLED TO NO-FAULT BENEFITS, so long as the drivers of the cars have the appropriate insurance coverage (See Who is Disqualified underneath diagram).

Green Car - This car is the problem in the diagram, the “at-fault” driver ran a stop sign.

This driver is 100% at fault for the accident, can only make a claim for No-Fault Benefits from their insurer, they may not claim pain and suffering from anyone because they are the negligent driver.

Yellow Car - This car is following the law while proceeding through the intersection prior to the accident. The injured person(s) in this vehicle can make a claim for No-Fault Benefits from their insurance company and may sue the Green Car Driver for pain and suffering.

Motorcycle - Also following the law driving the opposite direction of the Yellow Car at the time of the accident. The motorcycle can claim No-Fault Benefits because a motor vehicle was involved in the accident (motorcycles are not considered motor vehicles under the No-Fault Act) and may also sue the Green Driver for pain and suffering.

Pedestrian - This person is on foot and crossing the street at the corner while the Green Car is supposed to have come to a stop at the stop sign. They may claim No-Fault Benefits and sue the Green Driver for pain and suffering.

FIRST PARTY CLAIMS - made with your insurer or the insurer applicable to your situation

That’s what “No-Fault” means: regardless of fault, insurance coverage must pay benefits. No-Fault insurance in Michigan is like medical insurance for driving. Everyone looks to their own insurance FIRST for claims. These are considered “first-party” claims. These types of claims aim to reimburse or pay for Economic Loss (See Benefits underneath diagram). The law allows consumers to elect different levels of coverage, prior to 2019 No-fault coverage for injuries arising out of an accident was unlimited and available for the life of the injured party; Valentine Legal recommends getting the most insurance coverage that you can reasonably afford.

THIRD PARTY CLAIMS - suing the “at-fault” driver:

If an injured person is not more than 50% “at-fault” for the accident and their injuries reach a certain threshold they are entitled to sue the at-fault driver for pain and suffering; non-economic damages.

Returning to our diagram:

Green Car: is the negligent, “at-fault,” driver. This driver ran a stop sign causing injuries to everyone involved. All of the injured persons may sue the Driver of Green Car for pain and suffering (yellow car, motorcycle, and pedestrian). The Driver of the Green car may not sue anyone for pain and suffering as they are 100% at fault for the accident.

Third-party claims are only able to go forward if the accident causes death, permanent disfigurement, or “serious impairment of an important body function.” Serious impairment is reviewed by Courts on a case by case basis; the legal standard is: an objectively manifested impairment of an important body function that affects the “person’s general ability to lead his or her normal life.” As this involves a complex analysis, please contact Valentine Legal to discuss the specifics of your case.

One may also sue the “at-fault” driver for additional economic damages over the limits of their own insurance. Example: If the injured person’s insurance limits are $50,000 but their injuries require more medical treatment, work loss, etc. they may sue the at-fault driver for additional benefits.

UNINSURED AND UNDERINSURED COVERAGE - Making third-party type claims with your insurer

What happens if the “at-fault” driver doesn’t have enough coverage for your pain and suffering or doesn’t have any coverage at all? You may look to your own insurance policy depending on the policy elections you make. Once again, Valentine Legal recommends obtaining the highest limits that you can reasonably afford.

Example: You are injured by a negligent driver and your injuries meet the legal threshold you are entitled to pain and suffering damages. If your case is worth $100,000 but the “at-fault” driver only has $20,000 in coverage you are missing out on $80,000 - depending on your coverage elections you may claim additional damages from your policy.